Must be a first-time homebuyer. First Time Buyers More Home buyers do not have to be a first-time home buyer to qualify.

Fha Loan Calculator Check Your Fha Mortgage Payment

Note- FHA eligibilty is for US.

. You may also have the opportunity to choose the term of your loan for example 15 20 or 30 years the interest rate structure the amount of your down payment and the terms under which you can repay your loan. In practice however a 20 down payment is too hefty for most borrowers. To afford a house that costs 250000 with a down payment of 50000 youd need to earn 37303 per year before tax.

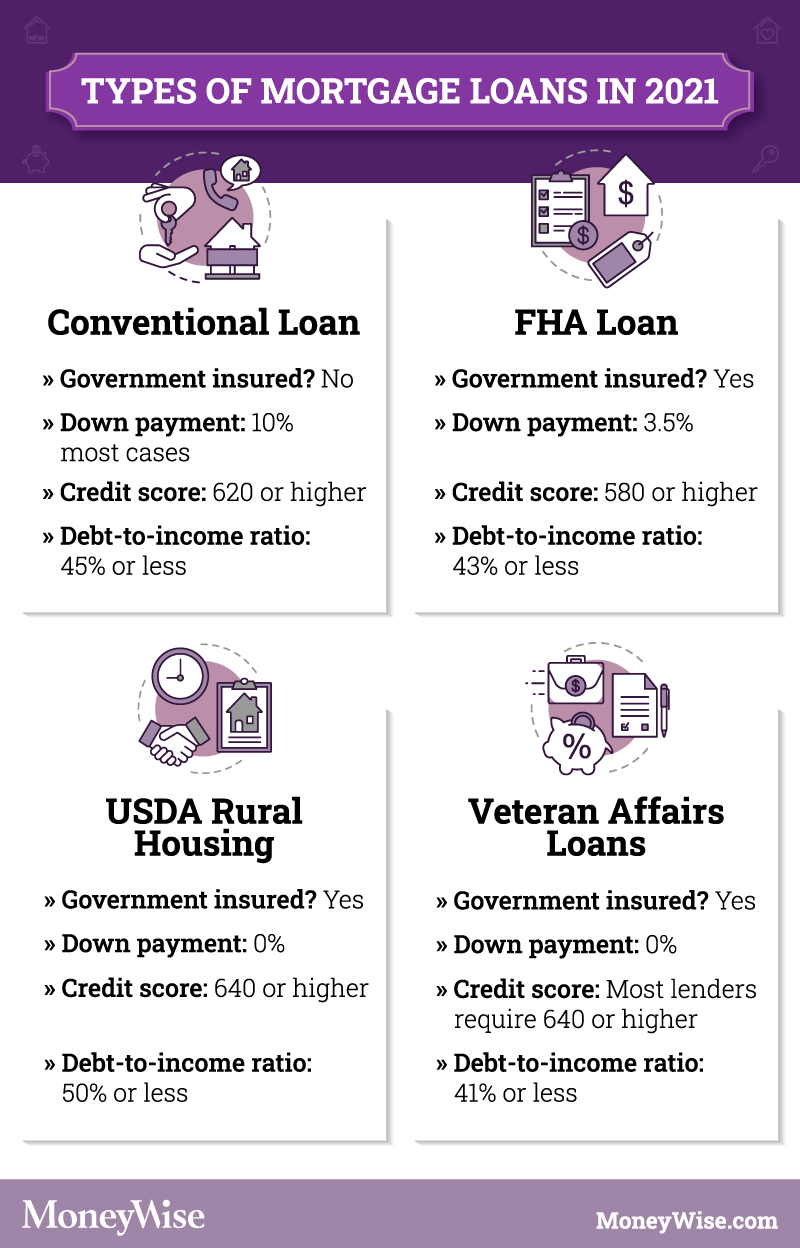

Your down payment age of the car and the term length may also affect the rate. Credit reporting agency Experian reported that the average down payment for homebuyers in 2018 was 13. Conventional FHA VA and USDA fixed mortgages are all.

Yet first-timers are usually the ones who benefit the most from this lending guideline. Department of Housing and Urban Development. Optional Plus grant is up to 2500 for down payment and closing costs no repay or optional second mortgage below.

Consider two individuals who each want to buy a home valued 100000 and can each put down 10000 or 10 of the value of the. One thing you should know as a first-time or repeat home buyer is that mortgage lenders allow financial gifts to be used toward the down payment on a house. An FHA Home Loan Specialist will review your information and respond within one business day.

At Enterprise Car Sales we can help you find rates and terms that work for you. When a covered item breaks First American will send a pre-screened service contractor to your home to diagnose and repair or replace the item. For a home purchase you can choose from conventional loans and government-backed loans such as FHA USDA and VA programs.

A downpayment is a percentage of the total amount of the vehicle and is only made after a purchase contract has been agreed upon. Most first-time buyers manage to purchase a home by saving for a down payment over a period of years or perhaps by receiving gifts from parents or other family members. The monthly mortgage payment would be 870.

A car vehicle downpayment receipt is a written record of the initial payment from a buyer to seller towards the purchase of a vehicle. Salary needed for 250000 dollar mortgage. Maximum amount up to 24999.

You must occupy the property as your primary residence for a minimum of four years. Department of Housing and Urban Development 451 7th Street SW Washington DC 20410 T. The 3 you may have put down on the home where you currently live isnt going to work for an investment property.

Meanwhile those who bought houses for the first time only made a 7 down payment whereas repeat buyers paid 16 down. How Credit Scores Affect the Cost of PMI. Many people who can afford the monthly mortgage payments and have reasonable credit will qualify.

Security Home Mortgage offers the easiest home mortgage experience you can imagine. The more common of the two is the 801010 mortgage arrangement in which the home buyer is granted an 80 percent loan-to-value LTV on the primary mortgage and 10 percent LTV on the second mortgage with a 10 percent down payment. A percentage you may hear when buying a home is the 36 rule.

But increasing home prices and stagnant or low wages can make this process difficult and many Americans lack the earning power to reach that home buying mark. Remember that the borrowers financial situation affects their down payment. Cuyahoga County Down Payment Assistance Program.

Please note that all programs listed on this website may involve a second mortgage with payments that are forgiven deferred or subsidized in some manner until resale of the mortgaged property. While the purchase contract will have details regarding the downpayment the buyer is recommended to request a. You must be a first-time homebuyer OR have not owned a home in the last three years.

Close on your home 17 days sooner. Rent-to-own also known as rental purchase or rent-to-buy is a type of legally documented transaction under which tangible property such as furniture consumer electronics motor vehicles home appliances real property and engagement rings is leased in exchange for a weekly or monthly payment with the option to purchase at some point during the agreement. Here is an example of how factors such as creditworthiness impact the cost of mortgage insurance.

Ideal for First-Time Homebuyers Low 35 Down Payment Requirements Credit Score Requirements as Low as 580. Credit scores dont just affect mortgage and homeowners insurance rates they also affect PMIS. A First American home warranty is a renewable yearly service contract that protects a homes systems and appliances from unexpected repair or replacement costs due to a break down.

Use the link above to get more information from the North. For example a first-time home buyer with little or no money in their bank account might choose a zero-down USDA loan. The average first time car buyer tends to pay a higher APR due to lack of credit history.

The NC Home Advantage program has a similar program offering 8000 in down payment assistance to veterans and firsttime homebuyers. As of 2019 the average down payment for first-time buyers is roughly 7 and is higher 16 for repeat buyers. FHA First Time Home Buyer - Apply Online.

The rule states that you should aim to for a debt-to-income DTI ratio of roughly 36 or less or 43 maximum for a FHA loan when applying for a mortgage loan. City of Columbus American Dream Down Payment Initiative. DOWN PAYMENT ASSISTANCE MAY BE AVAILABLE IN YOUR AREA.

Homebuyer education is required. About Bidens Tax Credit. The CHFA Down Payment Assistance Program is available to all eligible home buyers.

May be used for down payment andor closing costs. The piggyback second mortgage can also be financed through an 8020 loan structure. We will use this information to work with you and determine the best options available to you.

First-time homebuyer 3-year rule qualified veteran or target area buyer Feature. Department of Housing and Urban Development. Department of Housing and Urban Development 451 7th Street SW Washington DC 20410 T.

Home price the first input is based on your income monthly debt payment credit score and down payment savings. FHA loans are the 1 loan type in America. FHA Loans More.

If the act passes first-time homebuyers could claim their one-time tax credit of 10 of their homes purchase price up to 15000. You will need at least a 20 down payment given that mortgage insurance isnt. Gift funds are a valuable tool for first-time home buyers and repeat buyers alike.

First Time Home Buyer Utah Home Grants Buy Utah Homes

Best Down Payment Assistance Program Home Buyer Grants First Time Home Buyer Programs 2022 Youtube

Home Loans Mortgages Low Rates First Time Home Buyer Delta Community Credit Union

First Time Home Buyer In Indiana Down Payment Assistance In Indiana

Tips For First Time Home Buyers What You Must Know Before You Buy

First Time Homebuyer Loans Interest Rates Ufcu

Tips For First Time Home Buyers What You Must Know Before You Buy

Utah First Time Home Buyer Programs Of 2021 Nerdwallet

First Time Home Buyer Utah Home Grants Buy Utah Homes

Idaho First Time Homebuyer Assistance Programs Bankrate

5000 Weber County Utah First Time Buyer Utah Home Grant

Utah First Time Buyer Grant Programs

Biden Looks To Give A Big Boost To Homebuyers And Builders

First Time Homebuyer Grants And Programs Nextadvisor With Time

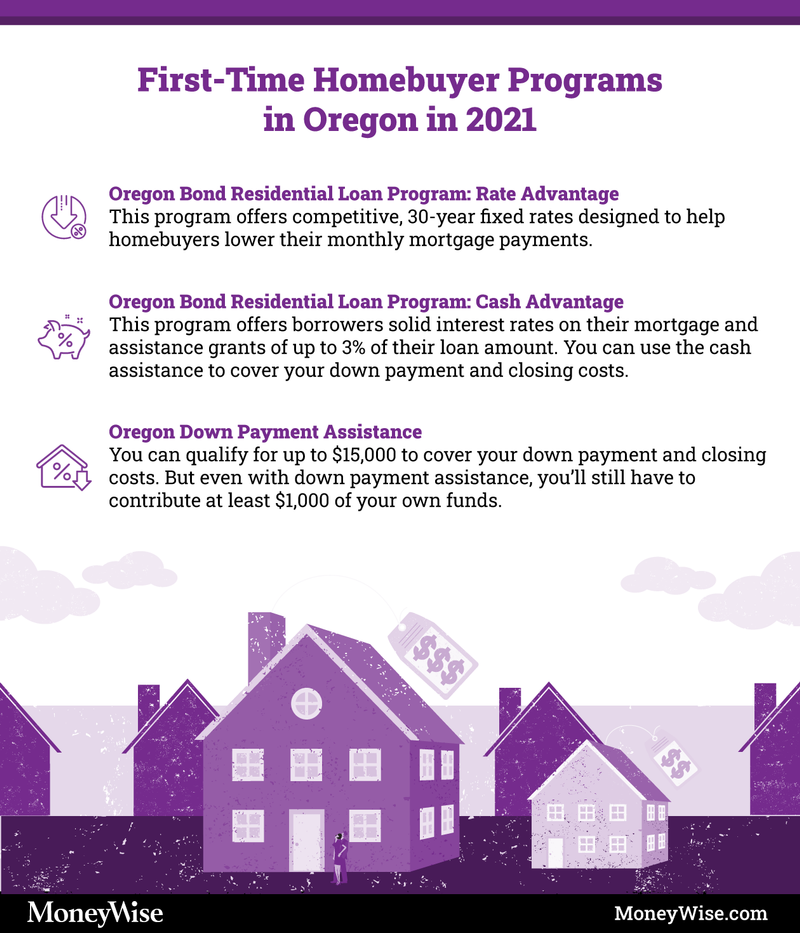

First Time Homebuyer Programs In Oregon 2021

First Time Home Buyer Programs In All 50 States Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Down Payment Assistance Programs In Every State 2022